Lump sum payroll tax calculator

Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts. Combine all lump-sum payments that you have paid or expect to pay in the calendar year when determining the composite rate to use.

2

We have the SARS tax rates tables.

. Ad Compare This Years Top 5 Free Payroll Software. Ad Process Payroll Faster Easier With ADP Payroll. A lump-sum distribution is the distribution or payment within a single tax year of a plan participants entire balance from all of the employers qualified plans of one kind for example.

Discover ADP Payroll Benefits Insurance Time Talent HR More. This will calculate net pay based on information entered and will provide a reasonable approximation of net pay. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds.

Total of lump sum payment and grossed-up annual value of employees income including the secondary tax codes low threshold amount if appropriate PAYE rate. With Lump Sum Payment. Ad Our Resources Can Help You Decide Between Taxable Vs.

With Lump Sum Payment. Financial advisors can also help with investing and financial plans including retirement. Lump Sum Extra Payment Calculator This lump sum extra payment calculator shows you how much money and time you can save when you make a lump sum payment or extra payment.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Enter up to six different hourly rates to estimate after-tax wages for. Free Unbiased Reviews Top Picks.

A financial advisor in Virginia can help you understand how taxes fit into your overall financial goals. Explore Tools That Allow You To Access Insights On Retirement Concerns. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Use this calculator to help determine whether you are better off receiving a lump sum payment and investing it yourself or receiving equal payments over time from a third party. Get Started With ADP Payroll. The key is to.

Ad Compare This Years Top 5 Free Payroll Software. Months to Pay Off. Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

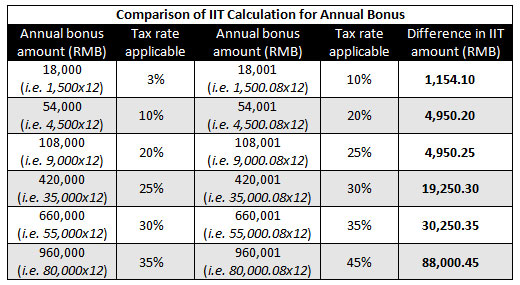

How to Calculate Taxes on a Lump Sum Sapling. Ad Discover Helpful Information And Resources On Taxes From AARP. Were often asked about tax brackets and how it works when lump sums of money are taken such as 401k distributions severance pay one-time pension payouts etc.

All Services Backed by Tax Guarantee. Free Unbiased Reviews Top Picks. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Lump sum calculator helps the investor to estimate the returns that will be made by a lump sum mutual fund investment. WinTax Calculator 200911 is a useful application which provides users with an easy way to calculate taxes on regular salary bonus retroactive pay and commission.

In the context of pensions the former is sometimes. From 1 April 2022. Price development of CHECK.

By making a lump sum payment you will repay your loan 58 months earlier and save. Months to Pay Off. Investing 100 in CHECK on Mar 2022 would result in.

By making a lump sum payment you will repay your loan 58 months earlier and save 9618 in. Use the following lump-sum withholding rates to. A lump sum calculator helps to calculate the maturity amount for a.

Lump Sum Net Pay Calculator This calculator is for estimating purposes ONLY. Federal Bonus Tax Percent Calculator. Lump sum investing calculator for Paycheck CHECK backtesting.

If your state does. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. Get Started With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll.

Extra Pays Lump Sum Payment In A Pay Run Payroll Support Nz

Netherlands Payroll Processing Outsourcing Guide Remote

Payroll Statutory Deductions And Reporting

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Malawi Revenue Authority Mra Pay As You Earn Paye Rates Lenvica Hrms

Section 80qqb Deductions For Royalty Income Of Authors Tax2win

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

Calculating Payroll Deductions In Canada Humi Blog

Income Tax Calculator Calculate Income Tax Online For Fy 2021 22 Fy 2022 23 Max Life Insurance

Lump Sum Payments To Departing Employees

Confluence Mobile Support Wiki

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Lump Sum E Payment Tax Offset 2022 Atotaxrates Info

Lottery Tax Calculator

Malaysian Bonus Tax Calculations Mypf My

Use Our Paye Calculator To Work Out Salary And Wage Deductions